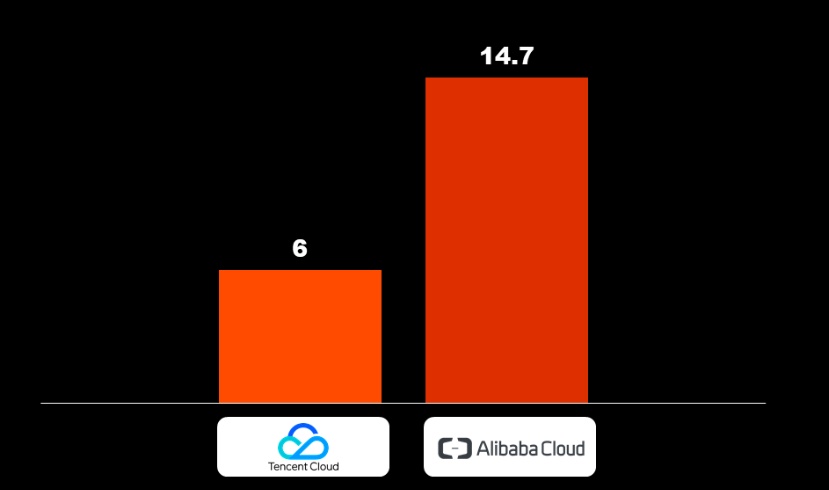

The 10-year-old two-and-one, also allowed Ali to pass the "skill training" every year, reversing the impression that the outside world has long run for Alibaba. Ma and Zhang Yong, on different occasions after this year, said that the two-to-one maximum is still the technical strength of the practice, and can be energized to form the basis for future development. In the third quarter of this year, the revenue of Tencent's cloud grew by 80%, and it appeared to be growing fast, but the price of the plate was relatively small, only $4.7 billion, or about 6.69. Billions of dollars. The $9.3 billion ($1.3 billion) income from Alibaba Cloud, while Alibaba's third-quarter revenue grew at a growth rate of 64% year-on-year. Tencent's other business, such as gaming business, was also hit by a regulatory level last year, a recovery in the third quarter and a year-on-year growth in Tencent's online games and smart mobile gaming revenues in the third quarter. But an investment bank, Jeffrey's analyst, recently wrote in a report that any "The launch of the new game is not successful" would be a major potential risk for Tencent's future.

In the same week, Mr. Ali's performance was in great trouble: Mr. Ma said that this year's double-decade disadvantage was on Monday. But the price of the two-year-old cat has reached a new record of $268.4 billion. After a day or two, Mr. Ali started a second-time program to go to Hong Kong, raising $100 to $1.5 billion, which could be the world's first-largest IPO this year, and once Mr. Ali has successfully listed in Hong Kong, The company's total market value in the two markets in the United States and Hong Kong is likely to exceed $50 billion, and the market value of Ali at the U.S. exchange is $479.33 billion. Mr. Ali's listing in Hong Kong also allows Ali and Tencent to be on an exchange with each other.

But Tencent's recent earnings figures dismayed investors, with revenue of 97.236 billion yuan in the third quarter, up 21 percent from a year earlier, falling below market expectations of 99.044 billion yuan, and net profit of 20.382 billion yuan, down 13 percent from the same period last year, which was also lower than the market forecast of 23.531 billion yuan. Tencent's decline in PC gaming and advertising revenue was the main cause of poor performance in the third quarter. Tencent's shares fell 2.3 percent after the results were released, making it the worst performing stock in the Hang Seng Index on the day and Tencent's biggest one-day decline in the past three weeks.

(picture source:搜狗图片)

Tencent and Ali, the largest two Internet companies in China, are also often striking. But in 2019, the development of Tencent and Ali has been very different, and Tencent is experiencing a low tide in the process of transforming the industrial Internet, while Ali has maintained its growth on the basis of the rapid development of e-commerce. Since the organization's restructuring in 930 Tencent last year, many of the interviews with Tencent have been related to the "change", and the biggest feeling of COO Ren Yuxin is to talk more directly, less and more, and more fighting. He Yuxin On November 11 this year, the core values of Tencent were also updated from "Integrity, progress, cooperation and innovation" to "Integrity, progress, collaboration, creation". It looks like Tencent is step-by-step from a 2C-based social, gaming Internet company to a 2B-based industrial Internet company.

In addition, Alibaba's share price is about 15% higher than that of the New York Stock Exchange, and Tencent is only 1% higher than the Hang Seng Index. Mr. Bernstein also predicted earlier this year that Tencent's revenue growth in the next three years will be lower than Alibaba, as Tencent's business is dispersed in several different segments of the market. The final summary of Bernstein's study concluded that the "Alibaba has developed better because its core business is still strong."

Overall, however, most analysts remain extremely optimistic about Tencent's future, arguing that Tencent has the ability to develop its financial technology business and will expand its mobile gaming business to boost Tencent's overall recovery. Analysts who say Tencent's average recommendation to Tencent is "strong buy" Bernstein also believes Tencent's mobile gaming and advertising revenues are likely to accelerate in the coming quarters and that its video streaming business should recover.

Although Ali is not the same as Tencent's core business, Ali is based on ecommerce transactions, while Tencent is the king in social and gaming fields. "over the past 20 years, Ali and Tencent have had similar revenues and market capitalization, growing at about 30 percent a year," Internet research analysts at Bernstein wrote in an August study. But in 2019, Alibaba's share price outperformed Tencent, up 33 percent from the start of the year, while Tencent was up just 3 percent.